Thousands of businesses all over the world use QuickBooks, which is the best accounting solution available. It assists in the management of all inventories that is tracked and includes completed data in the form of statements. You can pay your workers without having to write or print checks if you use Direct Deposit. But most of you might not be aware of the process to activate and use it. Don’t worry! This article is framed for the purpose to help you with a simple and easy process for how to Activate and Use QuickBooks Direct Deposit. So let’s get started with the requirements that you need to have.

Some Specific Requirements to Sign up for QuickBooks Direct Deposit:

Having all the needed items would be easy sign up for the users:

- Active subscription of QuickBooks Desktop.

- Easy and proper Internet access.

- Check the version of QuickBooks that you’re using is supported for direct deposit or not.

- Add EIN (Employee Identification Number) to QuickBooks Payroll to use the direct deposit feature.

- You should have a bank account that can manage all the transactions associated with Automated Clearing House (ACH) within the United States.

Things to do Before Start Using QuickBooks Direct Deposit:

Few important things must be performed before activating or you start using the QB Direct Deposit. Let’s check out what are them:

Verify the Bank account:

At the time of sign up when you provide the basic bank details for security purposes, Intuit performs two small withdrawals of less than $1.00 each from the bank account you set up for Direct Deposit. Investigate your bank account for the sums and then verify them in QuickBooks.

After successful verification, you become an authorized user of the account and then bank account if ready for authorized payroll transactions and fees. Once your bank account is confirmed then Intuit automatically refunds two small test debits within 7 working days from the original debit date.

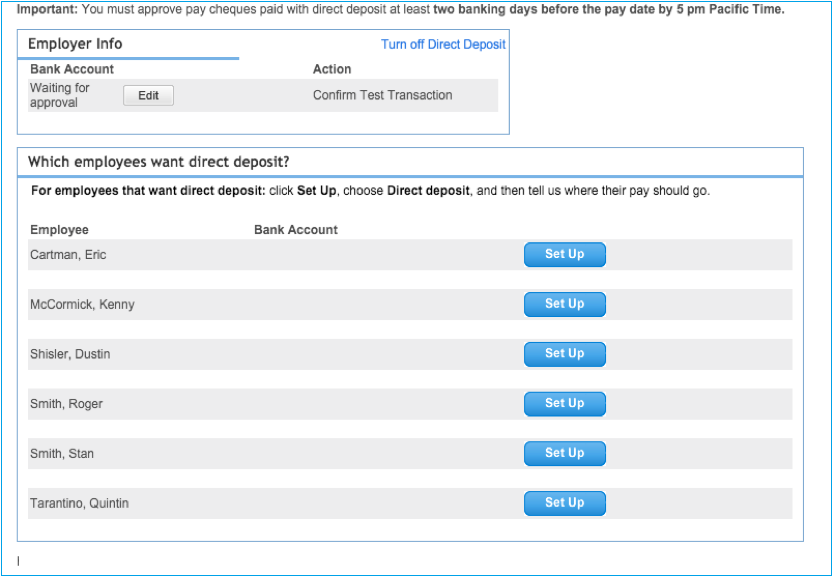

Setup the Account Details of the Employers in QuickBooks Payroll Account:

Gather bank account details from employees who like to be paid by Direct Deposit. The worker must give written approval to you for DD of their paychecks.

- After doing all the things, you can create Paychecks for employees by using DD (Direct Deposit).

Direct Deposit Processing Timeline:

- Before 5:00 p.m. PST, the DD should be forwarded to Intuit QuickBooks, and it takes two banking days before the check date.

- During this time, the transaction status remains pending.

- If necessary, you can cancel all previously sent paychecks or submit additional paychecks.

- Payroll offloads at 5:00 p.m. PST, two banking days before the check date.

Important Note: “Paychecks can be forwarded to 45 days in advance“

- Holiday reminder

- The payroll if offloaded

- DD payroll is offloaded at 5:00 PM PST two banking days before the paycheck date.

- Without a fault, Intuit cannot interrupt Direct Deposit transactions at any time.

- Payroll from QuickBooks DD is electronically submitted to ACH (Automatic Clearing House) for processing.

- Intuit will debit your bank account the day before your paycheck date, which can be as soon as 24 hours.

- Refund are posted

- On the pay day, funds are deposited into the employee’s account.

- The employee’s bank verifies the Direct Deposit posting time and availability of funds; Intuit has no control over this detail.

- If a non-banking day falls on a payroll day, the funds will be deposited into the employee’s bank account the next banking day.

- The Employee’s bank has until 11:59 PM on the day of the check date to post the funds to the employee’s bank account.

Steps to be Performed for Signing up and Activation of QuickBooks Direct Deposit:

Carefully Execute the Below Steps Given below:

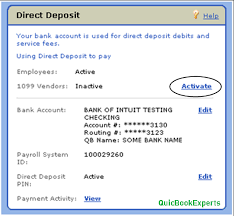

➤ First, go to the Main menu and select the Employee Tab

➤ Next, select the option “My Payroll Services”

➤ Now, select and click on the “Activate Direct Deposit”

➤ After Finished, you need to Review the Form

➤ In the legal company details, you’ll asked for a Pin Code

➤ Then you need to enter 5-digits only without the extension

➤ Now, in the Company Verification Section:

➤ You have to add the Legal Company along with Address to add the industry

➤ After that, choose the most suitable industry to consider the main business of your company

Note: “The Pin Code must be entered only 5-digit without the extension”.

- Once done then add the Credentials of Company Owner (credentials includes Email ID, DOB, Nine digit SSN)

Note: “Credentials are necessary to fill as per the rules and regulations by NACHA (National Automated Clearing House Association)”

Carefully Execute the Below Steps given below:

➤ Now, you also have to verify the Payroll Administrator Details and Email Address

➤ In the Bank Details section:

➤ Enter the details of the bank account that QuickBooks Payroll debits for Direct Deposit transactions and charges. You will use the bank account to pay your employees.

➤ Click on the View Agreement link and read it carefully

➤ Select the checkbox which says to agree to the terms of service agreement

➤ Answer all the questions asked in the Check Security limits section

➤ Hit the Submit tab

Note: “If nothing happens after clicking the Submit button; remove all the details on the form including the details on the Edit links, re-enter the information manually then click Submit once again”

- After the submission is successful completed then a confirmation window appears with the next instructions, you can take print out of that

- Finally, click on the “return to QuickBooks” tab at the button in the appear page.

Instructions to Set up the Employee for QuickBooks Direct Deposit:

- Initially, select Employees >>> the Employee Center

- Next, perform double-click on the Employee’s name

- And then select the tab “the Payroll Info”

- After that, hit the “Direct Deposit” button

- In the Direct Deposit window, click on the “Use Direct Deposit for [employee’s name]”

- Select the option whether to deposit the paycheck into one or two accounts

- Enter the information of the Employee’s Financial Institution such as Bank Name, Account Number, Routing Number, and Account Type

- If you want to deposit to two accounts, fill in the Amount to Deposit area with the amount or percentage that the employee wishes to deposit to the first account

- The balance is transferred to the second account

- At last, click on the Ok to save all the information.

The next paycheck you make for the employee will be saved for the future direct deposit. You can uninstall and restore a paycheck if you want a direct deposit on one that has already been made but not sent. Re-check the box next to Use Direct Deposit in QuickBooks Desktop, then double-check that the direct deposit information is right and save the paycheck.

Steps to Edit Information of Employee’s Direct Deposit:

Before making a paycheck for the employee, you must edit the employee’s bank account information. Paychecks issued before the employee’s account details have been updated would be deposited directly into the old bank account. To stop this, follow the steps below to delete or edit and reform the paychecks before submitting them to Intuit:

- In the beginning, open the paycheck

- Then go to the Paycheck Detail window

- Next, uncheck the option “Use Direct Deposit” on the paycheck detail

- To save all the changes that are made, click the Save and then Save & Close tab

- Finally, open your paycheck once again and choose “Use Direct Deposit” >>> click Save.

Note: Download the latest version of QuickBooks & Save up to $50.

Pay a Contractor with Direct Deposit – Tutorial

Conclusion:

This is how you can Activate and Use QuickBooks Direct Deposit and hope while implementing the above steps, you don’t face any issue. In case, you have any difficulty then you can approach QuickBooks Professionals.

Frequently Asked Questions

Q1. What are the benefits to activate the Direct Deposit feature in QuickBooks Payroll requirements?

Ans: There is more than one benefit available after activating the Direct Deposit feature in QuickBooks Payroll requirements:

➤ No minimum or monthly fees

➤ You employees can be paid on schedule time

➤ No cost for sign up

➤ If you use the service you pay it, otherwise no

➤ No need for a minimum number of employees or paycheck is required

➤ You can schedule QuickBooks Direct Deposits Payments up to 45 days in advance and many more.

Q2. Is there any cost required to pay if I want to use the QuickBooks Direct Deposit feature?

Ans: Basically, it is free of cost or there is no fee applicable to activate the Direct Deposit for QuickBooks Payroll. However, QB activation of DD is free and it will cost you as per paycheck for the bank to bank transactions or by the transfer fee paid by the employer.

This charge is then processed when you run payroll and the charge may also vary according to the product subscription.

Q3. Can I permanently remove the Direct Deposit from an Employee’s Profile in QuickBooks?

Ans: Yes, you can do it for not paying the Direct Deposit to an employee. You can possibly remove them from the setup as well. To do so, go through the below steps:

➤ First, go to the Employees section and select “Employee Center”

➤ Do double-click on the employee name to edit the profile

➤ Next, click the tab with a named “Payroll Info”

➤ In the end, click on the “Direct Deposit” button and select the box to clear the option “Use Direct Deposit for this Employee”.