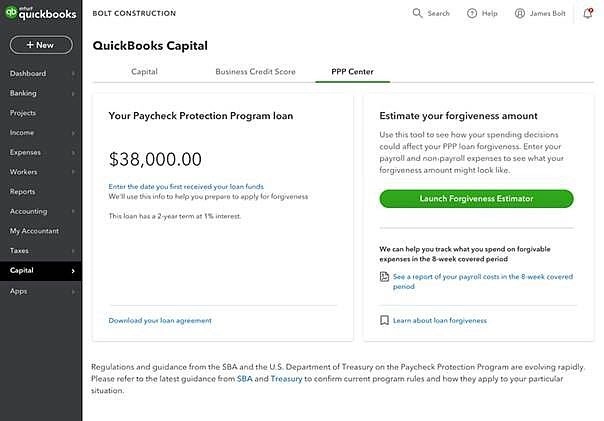

Seeking for financial help? Then you should read about the PPP which is created by QuickBooks Under the CARE Act which relies on average monthly payroll costs, you could be eligible for the loan up to $10 million as this is the part of the program, but you should use the 75% of the amount to cover the payroll and many other employee benefits. These benefits can be PTO insurance, premiums, retirements, etc. You need to just apply with some documents which are needed to apply for the PPP loan and once it is applied you are done. The best part of PPP loan is that it can be forgiven as well.

What is Paycheck Protection Program?

QuickBook launched an easier way to get financial help for small business owners, individuals self-employed and other eligible applicants to apply for the PPP. This program is part of the Coronavirus Aid relief and economic security( CARES) which allowed approx $659 billion to forgive loans to help you for paying employees and some certain operating expenses.

Benefit and Features of Paycheck Protection Program

This aid is specially designed to help businesses to keep employees on the payroll. The Primary use of the PPP program is to cover Payroll related expenses. Eligible payroll includes below things:

- Salaries

- Wages

- Expenses

- Commissions

- Vacations, sick, medical/parental/family leave pay

- State and local taxes

- Group Health coverage premiums

- Retirement contributions

In these taxes, federal taxes are not included. Paycheck Protection Program funds may also be applied to other qualified costs such as rent, mortgage, utilities, and interest payments.

How Paycheck Protection Program Works?

The working process of the Paycheck Protection Program is quite easy you just need to apply, after applying you would receive funds and once it is done you can apply for the loan forgiveness.

- Apply – easily apply for the PPP program loan with QuickBooks capital. One the application is submitted you will get a confirmation email. After receiving the email you can sign in, review and accept

- Receive Funds – Get the funds up to $10 million to cover payroll and other employees’ benefits such as retirement, insurance, premium, etc. It can also be used for mortgage, rent, etc

- Apply for loan forgiveness – Your loan which you have taken can be forgiven if you keep all the employees on the payroll for 8 weeks ad spend your loan amount as per the eligibility.

Documents Required for the PPP Loan:

To apply for the PPP program in QuickBooks you need to prepare with some documents which are mentioned below. Make sure to collect below-mentioned documents to apply for the loan

- Articles of incorporation for each borrowing entity

- By-Laws or operating agreement for each borrowing entity

- Copies of each owner’s driver license

- Payroll expense Verification

- Certification of employees living in the United States

- List of employees who do not live in the US with the salaries

- Profit and loss of 12 months

- Proof of expenses

Specifications of PPP Loan:

By using the PPP loan you can get some below benefits and keep working with your business and employees.

- Keep Continue to pay your employees

- Track your expenses

- You can run a report that how much you have spent

The Paycheck Protection Program (PPP) | How Intuit is Helping Small Businesses

How to Get Help?

For any assistance feel free to contact. You can contact through the customer form available on accountingguide.co or email , once experts receive your query they get back to you within 3 to 4 hours. QuickBooks Helpdesk is available 24*7 to assist so that you can work any time without fearing for any errors. You can also do a live chat with the Experts anytime and solve your doubts and queries.