In accounting and bookkeeping, it’s usual to write off bad debt in QuickBooks. The QuickBooks accounting software performs the same operation. There are a few steps to follow in order to write off bad debts in QuickBooks Desktop or Online. Bad debts must be written off because the user may run into problems during bank reconciliation, and it will also help to eliminate discrepancies and profit/loss statements. Writing off bad debts in QuickBooks allows you to clear bills from your account receivables, allowing you to collect the correct profit amount. Overall, bad debt is a term used when a user offers things on credit to a customer who does not pay. The below write-up explains the complete process for how to Write Off Bad Debt in QuickBooks.

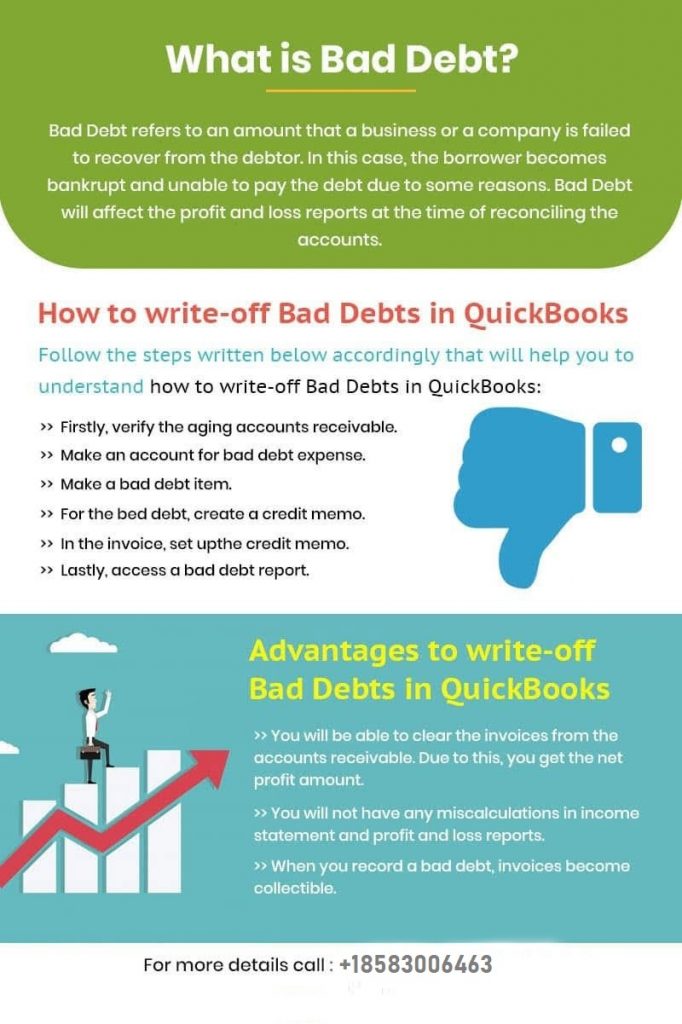

Understanding of Bad Debt in QuickBooks:

Amounts that are unable to be recovered from the debtor are referred to as bad debts. The borrower, who owes you money, is referred to as a debtor. Bad debt occurs when a debtor is unable to pay the amount owed. While reconciling the accounts in QuickBooks, debt concerns might have an impact on the profit and loss reports.

Uncollectible accounts are bad debts that are associated with account receivables. Bad debts can be written off as a deduction if the company follows the accrual accounting approach. Accounts receivable and net income are kept up to date by writing off bad debts.

Step by Step Instructions to Write off Bad Debt in QuickBooks Desktop:

If you use QuickBooks desktop, the actions outlined below will undoubtedly assist you in writing off bad debts. Let’s take a glimpse at the below steps:

Step 1: Creating an Expense Account Named Bad Debt:

🔶 In the top navigation bar, you’re required to the Lists

🔶 Next, select the Company option

🔶 Now, go to the Chart of Accounts

🔶 Create a new expense account just by clicking on the account tab

🔶 And then hit the “New” tab and then you need to select “Expenses”

🔶 After done with that then type in bad debt in the required account name field

🔶 At last, click on the Save & Close tab.

Step 2: Recording and Closing of the Bad Debt in QuickBooks:

🔶 First, go to the Customer menu and select “Receive Payments” tab

🔶 Next, enter the customer name in the receive from and $0.00 in the payment amount.

Note: User can write invoice number of the bad debt for tracking of the bad debt

● Now, click on the tab “Discount and Credits”

● After that, enter the amount of bad debt that user wants to write-off in the required field of discount amount

● Once done then you’re supposed to select the bad debt account which were created in the above step

● In the final step, click on the Save & Close tab.

Step by Step Instructions to Write off Bad Debt in QuickBooks Online:

Writing off bad debt in QBO is not the same as it was in the Desktop Version. As a result, it is recommended that you carefully carry out each and every step:

Step 1: Check Account Receivable (A/R) Aging Report

💠 Select the option “Reports” from the left side of navigational panel

💠 Next, look for “Account Receivable (A/R) aging report

💠 In the list, select the invoice which should be written off as Bad Debt.

Step 2: Create an Expense Account named “Bad Debt”

💠 Move to the Settings section >>> Chart of Accounts

💠 From the New button, create an expense account

💠 Select expenses in the “Account type” and then enter Bad Debt in the “Details type”

💠 At last, click on the Save & Close tab.

Step 3: Create an Item as Bad Debt

💠 Go to the “Settings” and then select “Products and Services”

💠 Next, select the “Non-Inventory” in the “New” section

💠 Now, name an item as “Bad Debt”

💠 Select the “Bad Debt” from the drop-down menu of Income account

💠 In the end, click on the Save & Close tab.

Step 4: Create a Credit Memo for Bad Debt

💠 In the beginning, click the “New” icon

💠 Next, select the “Credit Memo” in the Customer section

💠 Select the customer for whom you created as bad debt from the drop-down menu

💠 Now, select the item which you previously created as bad debt in the “Products and Services”

💠 Enter the amount of bad debt which you wish to write-off in the amount field

💠 At last, click on the Save & Close tab.

Step 5: Apply Credit Memo to Invoice

💠 Initially, click the + New icon and then select “Customers”

💠 Next, click the option “Receive Payment”

💠 Choose appropriate customer for a bad debt from the drop-down menu

💠 Select the invoice which you wish to write off as bad debt from the “Outstanding transactions”

💠 Select the Credit Memo which were previously created in step 4 from the Credit section

💠 Finally, click on the Save & Close tab.

Also Read: How to Fix QuickBooks POS Unable to Read Credit Card

Conclusion:

Once you’re done writing off the bad debt in QuickBooks, then you can run a report to check all bad debts and unpaid invoices. For the running report, click on the “Settings” icon and then “Chart of Account”. After that, click “Run Report” within the Bad Debt column.

Frequently Asked Questions

Q1. Can writing off the bad debt possible by cash basis taxpayers?

Ans: No, Cash basis taxpayers are not eligible to claim the bad debt deductions for any uncollectible amount. Cash-basis taxpayers are unable to deduct promissory notes as payments or declare receivables as income.

Q2. How is bad debt shown on my balance sheet?

Ans: In the balance sheet, bad debt is recorded as an expense, resulting in an asset loss/reduction equal to the debt amount.

Q3. How do I write off invoices in QuickBooks Online Accountant?

Ans: Go to the Accountant Tools and then select “Write-off invoices. Set the Invoice Age, To Date, and Balance less than filters to search the invoice. Select the “Find invoices” and then review the name within the Customer column. Select the check boxes for the invoices that you wish to write-off. Select the “Write-off” option and then choose an account that you want to use for bad debt in the Account drop down. Finally, click “Apply”.