Total Asset should always equal the sum of Total Liabilities and Total Equities on a QuickBooks balance sheet. Your balance sheet may occasionally become unbalanced as a result of wrongly entered or linked transactions which indicate that your total assets do not equal the sum of your total liabilities and total equities. If you have also made such mistakes and due to which the balance sheet goes out of balance. Don’t panic! This kind of issue usually arises due to human mistakes or some other reasons but it can easily be resolved that you’ll come to know in this particular article.

3 Possible Reasons that could Lead to QuickBooks Balance Sheet Out Of Balance In Accrual Basis issue:

- The company data file may get damaged

- You are using multi-currency feature

- The transactions you have entered or linked are not compatible.

Prerequisite Pointers need to Keep in Mind :

There are a few things that users should not avoid to overlook before starting the process to troubleshoot the error. Just have a glimpse of the following pointers:

- The user must change the reported total by Year and then verify that the balance sheet is balanced again.

- To see if the error has been addressed, the user can log out of QuickBooks and then log back in.

- Before attempting any troubleshooting actions, the user should make a backup of the QuickBooks company file.

- If the user is working in a multi-user environment, the company file may be damaged, and the balance sheet may become unbalanced. The user must repair the data damage and use the main system from which the file is hosted to resolve this.

- The last but not the least, before you proceed the troubleshooting, ensures to verify, rebuild, and check the QBWIN logs.

3 Quick and Easy Methods for How to Fix QuickBooks Balance Sheet Out Of Balance In Accrual Basis:

<!– /* Font Definitions */ @font-face {font-family:”Cambria Math”; panose-1:2 4 5 3 5 4 6 3 2 4; mso-font-charset:1; mso-generic-font-family:roman; mso-font-format:other; mso-font-pitch:variable; mso-font-signature:0 0 0 0 0 0;} @font-face {font-family:Calibri; panose-1:2 15 5 2 2 2 4 3 2 4; mso-font-charset:0; mso-generic-font-family:swiss; mso-font-pitch:variable; mso-font-signature:-469750017 -1073732485 9 0 511 0;} /* Style Definitions */ p.MsoNormal, li.MsoNormal, div.MsoNormal {mso-style-unhide:no; mso-style-qformat:yes; mso-style-parent:””; margin-top:0cm; margin-right:0cm; margin-bottom:10.0pt; margin-left:0cm; line-height:115%; mso-pagination:widow-orphan; font-size:11.0pt; font-family:”Calibri”,”sans-serif”; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-fareast-font-family:Calibri; mso-fareast-theme-font:minor-latin; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin; mso-bidi-font-family:”Times New Roman”; mso-bidi-theme-font:minor-bidi;} p {mso-style-noshow:yes; mso-style-priority:99; mso-margin-top-alt:auto; margin-right:0cm; mso-margin-bottom-alt:auto; margin-left:0cm; mso-pagination:widow-orphan; font-size:12.0pt; font-family:”Times New Roman”,”serif”; mso-fareast-font-family:”Times New Roman”;} .MsoChpDefault {mso-style-type:export-only; mso-default-props:yes; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-fareast-font-family:Calibri; mso-fareast-theme-font:minor-latin; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin; mso-bidi-font-family:”Times New Roman”; mso-bidi-theme-font:minor-bidi;} .MsoPapDefault {mso-style-type:export-only; margin-bottom:10.0pt; line-height:115%;} @page Section1 {size:612.0pt 792.0pt; margin:72.0pt 72.0pt 72.0pt 72.0pt; mso-header-margin:36.0pt; mso-footer-margin:36.0pt; mso-paper-source:0;} div.Section1 {page:Section1;} –>

Select the Year by Following Steps:Well! You know what are possible reasons and important pointers that must be considered. Now, let’s proceed with the methods to start troubleshooting the Balance Sheet issue:

Method 1: Try Selecting the Year or Month with the help Below-Mentioned Steps

Select the Year by Following Steps:

💠 Go to the Expand Options in the drop-down >> Select All

💠 Select the year from the Display columns

💠 After that, hit Ok

💠 And finally, compare the Total Assets and Total Liabilities to locate the year the balance sheet went out of balance.

Select the Month by Following Steps:

💠 In the Form and Field, enter the year that your QuickBooks balance sheet became unbalanced

💠 Next, choose the correct month from the display month

💠 And then hit the Ok button

💠 To find the month when the issue arose, compare the Total Assets and Total Liabilities entries.

Method 2: Look for the Transaction which is Causing QuickBooks Balance Sheet is Out of Balance:

💠 In this method, there are mainly steps involve:

Step 1: Track down the Date when the Balance Sheet shows Out of Balance (Narrow Down the Dates)

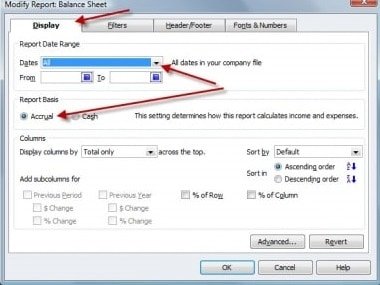

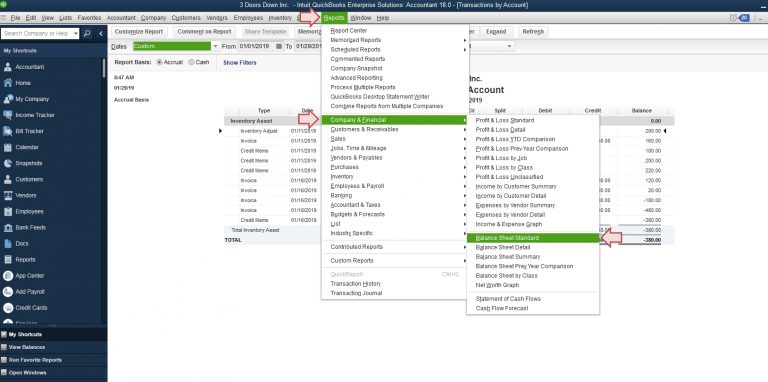

💠 First, go to the Reports menu and select Company & Financial >>>> Balance Sheet Summary

💠 Next, choose the Customize Report in the dialogue box

💠 Now, hit the Display tab

💠 After that, rearrange the Report Basis (Cash or Accrual) whatever is evoking out of balance

💠 Once then done then select the data when the balance sheet goes out of balance year (by day, week, month, and year)

Filter by Year

💠 From the drop-down menu, you have to click “Select All” tab

💠 From the Display columns, choose the Year

💠 And then click Ok

💠 After that, compare the Total Assets and Liabilities.

Filter by Month

💠 Mention the year from the field where the balance sheet goes out of balance

💠 Next, select Month from the Display columns

💠 After that, click Ok

💠 And then do the comparison of the Total Assets and Liabilities once again.

Filter by Week

💠 In the beginning, from the fields section, enter the month in which it goes out of balance

💠 For the Display columns, choose the Week and click Ok

💠 And finally, do a comparison of the balance involved in the balance sheet out of balance.

Filter by Day

💠 From the From and the field, mention the week in which you find out of balance

💠 Next, form the Display columns, choose the day and then click Ok

💠 In the end, compare the balance once again to find out the day in which the balance sheet goes out of balance.

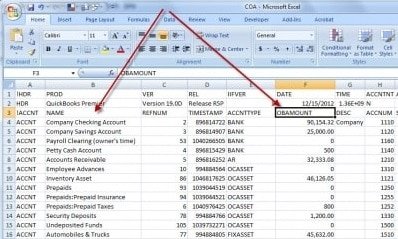

Step 2: Look for the Transactions which is Causing the Issue

💠 Now that you know the date when the balance sheet turned wrong, you must develop a custom transaction Detail Report to find out the transactions that caused the problem.

If you’re still having trouble finding out which transactions are out of balance, run the following reports for the same date:

Reports for the Same Date

💠 Vendor Report

💠 Customer Report

💠 Journal Report

💠 And other Transactions Report

Method 3: Try to Re-date your Transactions:

💠 After you discover the transaction which is causing the problem then you’re required to modify the date on them

💠 Including that, you need to make a note of their current dates

💠 Once done with doing that, edit the date on each and every transaction to a day 20 years in the future

💠 Next, click on the “Save each of the transactions”

💠 Now, refresh the report and if you spot the accurate transaction then the paid amount column will then be zero

💠 Locate the transactions which were dated into the future and then date them back to their actual date

💠 Make a consideration that re-dating steps should re-links the transactions so that you can easily amend them.

💠 Hopefully, this article is beneficial for you and with the aforementioned methods; you can easily fix the

🔶 QuickBooks Balance Sheet out of Balance in Accrual Basis. And continue keeping your transaction records of the balance sheet accurate and error-free.

Frequently Asked Questions

Q1. Is the Fixing of the Basic Data Damage Resolve QuickBooks Balance Sheet Out Of Balance in Accrual Basis issue?

Ans: Yes, you can try to fix the basic data damage that may resolve the issue. Here’s what you need to do:

➤ Using the troubleshoot option; you can resolve the data damage issue.

➤ By looking through the qbwin.log file, you can find and fix faults.

➤ Rerun the balance sheet report, then look at the Balance (what is the difference amount).

➤ Try to narrow down the time frame to figure out when it went wrong.

Q2. What do I Know when the Balance Sheet went out of Balance in QuickBooks?

Ans: You simply open your reports and select “Company and Financial”. Next, move to the Balance Sheet Summary and choose Customize Report. Hit the Display tab and set the Report Basis to Cash. Now, do the changes which are required as per the year/month/week/day when your QuickBooks Balance Sheet out of Balance issue occurred.

Q3. How to Remove and Re-enter the Transactions in QuickBooks?

Ans: If you want to change the dates on the transactions that don’t work then you are required to delete and re-enter them manually:

➤ In the upper-right corner, click the Gear icon and then select Audit Log

➤ Find the deleted transaction and then click View

➤ Click the arrow on when it was created and deleted

➤ Take note of the details of transaction

➤ Finally, recreate the transaction manually by clicking the Create menu (+).