QuickBooks Audit Trial Removal Service is essentially a service to get rid of the audit trail from a QuickBooks file. This can scale back the size of the file by a maximum amount of 30 to 50% and significantly speed up the information file. This service also will delete entries within the Voiced/Deleted Transactions outline and Detail reports.

In this post, we are going to discuss about Delete Audit Trail in QuickBooks in details and talk about how to delete them.

What is QuickBooks Audit Trail?

QuickBooks maintains an inside Audit path to record all changes created to each dealing within the record. This is an often tremendously useful tool for Accountants/Bookkeepers to trace users who have created changes to transactions and different details like amounts, etc. Because the variety of transactions increases in every record, the audit trail grows by an element of two, thereby increasing the scale of a QuickBooks record. Removing the audit trial brings down the file size of the data file and accelerates Delete Audit Trail in QuickBooks. It’s additionally typically needed to get rid of the audit trial once returning data files to the government or different agencies like the CRA and federal agency in cases of data audits.

How Does Audit Trail Work?

Let’s discuss the Audit Trail function of QuickBooks in details in this section.

QuickBooks online maintains a log of every monetary group action because it is added, changed, or deleted. The Audit Log is an audit path that enables you to see precisely created changes, and who created them. This is typically agreat tool for Accountants and Bookkeepers to trace users who have created changes to transactions and totally different details like amounts, etc.

Few Points to Understand About QuickBooks Audit Trail Reports:

💠 To access it, you need to have full access rights.

💠 For audit and security reasons, you cannot disable it.

💠 You can use the Audit Log to analyze changes created to private or multiple transactions. The info you will find includes:

💠 The date of the amendment

💠 The name of the user who earlier created the amendment.

💠 Type of amendment or event.

💠 The name of a client or merchandiser associated with the amendment and any original group action date and quantity.

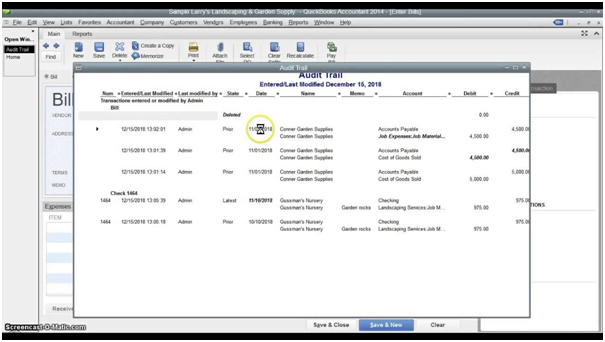

In addition, for many transactions or events, you’ll be able to choose to read within the History column to open the Audit History, Particularization changes to private group action or event.

How to Run QuickBooks Audit Trail Reports?

To run the Audit Trail reports you have to follow the following instructions:

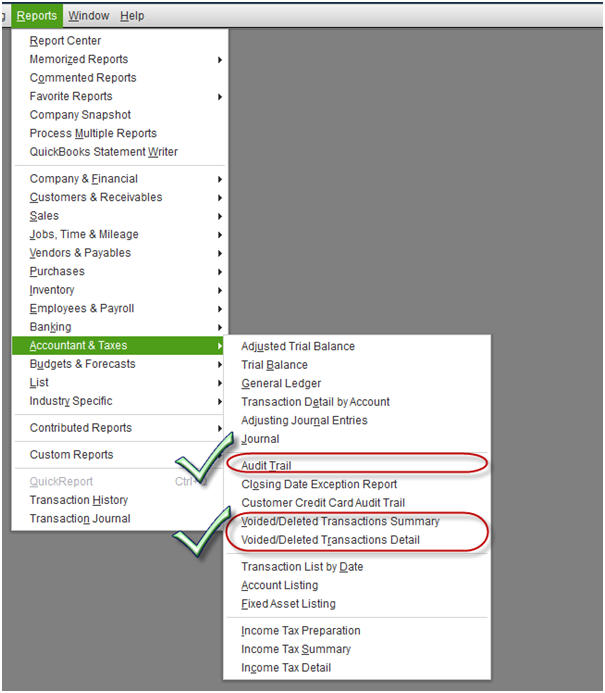

- First of all, go to Reports.

- Now, click on Accountant & Taxes.

- Here you will see these two reports.

- Report 1: Audit Trail

- Report 2: Voided/Deleted Transactions Summary or Detail

What are the advantages of an Audit Trail Report?

One of the troublesome issues that controllers and bookkeepers typically encounter is making an attempt to find missing or historical transactions. At times, there are instances when you just have entered any specific transactions; however, you’re unable to seek out it in the chart of accounts or the other company files.

See also:

How to Reprint Check and Paycheck in QuickBooks

Audit trail report provides the fingerprint of every single dealing that you just have recorded in QuickBooks Desktop. For instance, by using Audit Trail Report you’ll be able to simply check all the changed transactions, entries, deleted transactions, and even voided transactions.

Disadvantages of Audit Trail Report?

As the variety of transactions increase in every record, the audit trail grows by an element of two, thereby increasing the dimensions of a QuickBooks record, and decelerating QuickBooks down significantly.

What does the Audit Trail Removal do?

Removing the audit data brings down the file size of an information file and fastens QuickBooks. The Delete Audit Trail in QuickBooks could be a way to get rid of the audit trail from a QuickBooks record. This may scale back the size of the data file by the maximum amount of 30-50% and significantly speed up the information file. This service also will delete entries within the Voiced/Deleted Transactions outline and Detail reports. It’s additionally usually needed to get rid of the audit trail once turning in knowledge files to the government or alternative agencies like the CRA and Internal Revenue Service in cases of data audits.

Removing the audit trail knowledge doesn’t impact QuickBooks in any means however rather helps in maintaining an occasional file size and improved performance in QuickBooks. This service works for QuickBooks U.S., Canada, UK, AU, and NZ knowledge files.

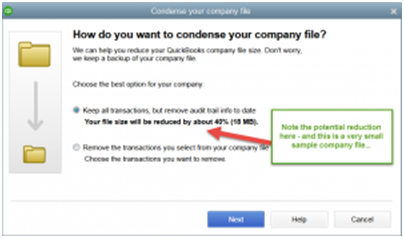

How to Delete Audit Trail in QuickBooks?

- First of all, launch the QuickBooks Desktop software.

- Now, look for the utilities option.

- Choose either the clean-up company data option or condense data option. It depends on the version of the QuickBooks Desktop you are using.

- Next, you have to select the range of the data from when you wish to clear the audit trail.

- You may have to tick all the boxes that appear on the screen.

- Finally, initiate the clean-up.

You can also perform the same process to clear audit data in QuickBooks Enterprise for Mac.

Final Words on How to Remove Audit Trail in QuickBooks!

Hopefully, the post helps you in understanding everything there is to know about Audit trails in QuickBooks and the process to Delete Audit Trail in QuickBooks it. However, if you come across certain errors or technical difficulties during the process.

It is best that you get in touch with our expert for QuickBooks Live chat team who works round the clock to provide you with the best assistance that you can hope for. So, give them a call or write to us right away.

💠Frequently Asked Questions💠

Q 1. How Does the Audit Trail Feature in QuickBooks Work and Why Would I Need it?

Ans: The Audit trail function is sued to record all types of transnational changes made to your data file, such as additions, deletions, and updates. Additionally, you can also benefit from the following features:

💠 Assisting in finding deleted transactions that may be causing discrepancies in opening balances and bank reconciliations

💠 Locating previous account names that may have been merged with new accounts

💠 Tracking user login times and activity

💠 Identifying users who may require further training by noting an increase in their voided or modified transactions

💠 Helping identify transactions that have been entered incorrectly or lost due to accidental deletion

💠 Keeping informed as to who is accessing the books and what tasks they are performing.

Q 2. Where Can I Find the Audit Log Report?

Ans: The audit log report is different from a transaction history report. While the transaction history report is certainly useful, the audit log serves as a more comprehensive and detailed log.

If you are a QuickBooks Desktop user, you can access the audit log report by following these steps:

💠 Go to “Reports”

💠 Select “Accountant and Taxes”

💠 Click “Audit Trail”

If you are a QuickBooks Online user, use these steps:

💠 Go to the “Gear” icon

💠 Select “Audit Log”

Q 3. How Can I Report an Audit Trail in QuickBooks?

Ans: To repost an Audit Trail in QuickBooks, do the following:

💠 Click Reports at the top menu bar and choose Account & Taxes.

💠 Select Audit Trail.

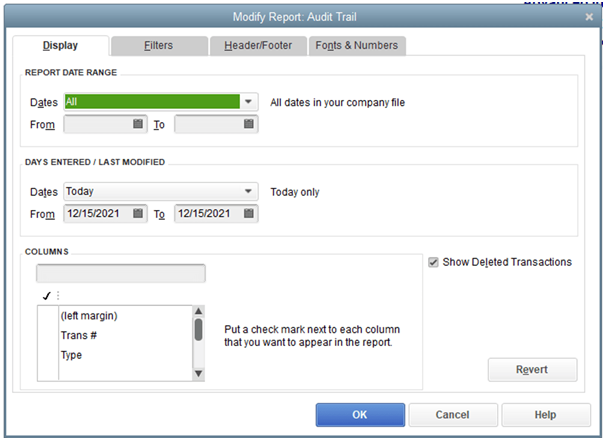

💠 On the report screen, click Customize Report.

💠 Go to the Filter tab and search for Transaction type.

💠 Choose Invoice and hit OK.

💠 Filter the dates.

Q 4. Does Removal of the Audit Trail Affect QuickBooks?

Ans: No. Instead, removing the audit trial helps in keeping a low file size with enhanced performance of QuickBooks.

See Read More:

A Complete Guide – Bills Management in QuickBooks Online

Install QuickBooks 2020