The QuickBooks accounting software is widely appreciated for its comprehensive reporting tools. It generates different types of reports to help you assess how well your business is performing. They let you compare your actual expenses and revenues to the budgeted amounts of your company. You can also analyze these reports to identify possible cost savings opportunities, sources for revenue or expansion, and errors related to incorrect accounting entries and so on.

In this blog, we will discuss how to run a budget Vs actual report in QuickBooks. If you are yet to create and use these reports in QuickBooks, this blog can help you immensely. We would recommend you to go till the end, implement the steps shown herein and get fully benefited from these comprehensive reports generated in QuickBooks.

What Does the QuickBooks Budget Vs Actual Report Show?

The Budget vs. Actual Report is a part of the QuickBooks Budget reports. It allows you to compare the actual revenues and expenses of your company , to the budgeted amounts. It also specifies the variance thereof, so that you come to know whether you are exceeding or falling short of the budgeted amount.

Read More-: How to Delete Memorized Reports in QuickBooks

How to Run a Budget Vs Actual Report in QuickBooks?

Please follow the step-by-step procedure shown below-

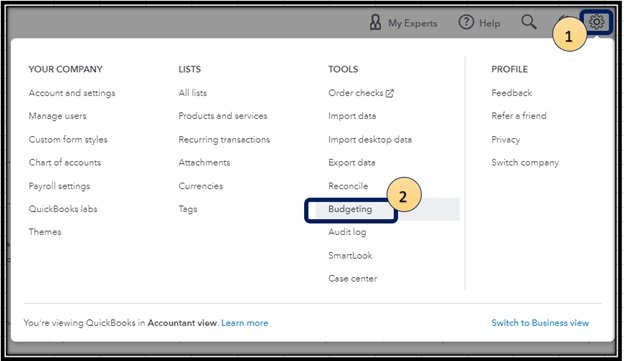

- Click on the Gear icon at the top.

- Click on the Budgeting tab

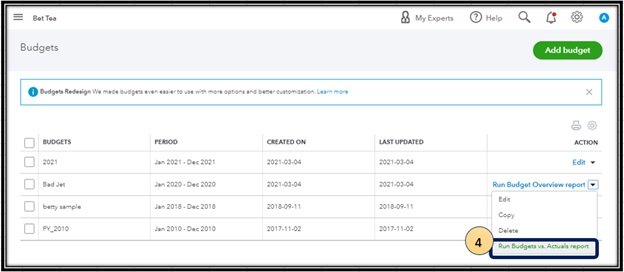

- Search for your budget from the list.

- Select the Action drop-down box

- Now press on the Run Budgets vs. Actuals report tab

Please note that this report summarizes budgets on the basis of accounts. It summarizes accounts together with your actual account totals. It also specifies if you are under or over budget and by how much.

Final Words :

In the discussion above, we have shown you a step-by-step procedure on How do you run a budget Vs actual report in QuickBooks. If you are still experiencing any difficulties in carrying out the above-mentioned steps or if you have any more queries, we would recommend you to speak to some of the authorized QuickBooks experts.

💠 Frequently Asked Questions 💠

What is the Profit & Loss Budget Performance Report in QuickBooks ?

The Profit & Loss Budget Performance Report is similar to the Budget vs. Actual Report. Only difference is that in this report , the actual revenues and expenses are compared to the budgeted amounts for the present month and year.

How Can I Copy an Existing Budget Report in QuickBooks?

In QuickBooks, you can create a copy of an existing budget. It would help you kickstart the Current year’s budget with the help of last year’s data:

▪ Select Settings

▪ Click on Budgeting.

▪ Search for the budget you wish to copy.

▪ Click on the Action dropdown box

▪ Now click on Copy.

▪ The Copy Budget window will appear on your screen

▪ Enter the new budget name and financial year.

▪ Click on the Create Budget tab

▪ Update the budget amounts as required.

▪ Click on Save /Save and close. The copy will be saved as a separate budget

How Can I Delete an Existing Budget Report in QuickBooks?

Please follow the steps below-

▪ Go to Settings

▪ Click on the Budgeting tab

▪ Search for your budget from the list.

▪ Click on the Action dropdown box

▪ Click the Delete tab

Please Note– be careful while deleting a budget. You will not be able to recover deleted budgets:

How Can I Customize My QuickBooks Budget Reports?

Please follow the steps below-

▪ Navigate to the Reports menu.

▪ Select and open the report you want to customize.

▪ Use the basic filters to adjust things such as report dates.

▪ Click Customize.

▪ The customization window will appear on your screen

▪ You can apply the following filters to customize your report-

▪ General section: you can change things such as the number format , accounting method and reporting period.

▪ Rows/Columns section: you can choose which rows and columns would appear on the report.

▪ Filter section: you can choose which vendors, accounts , customers, products and distribution accounts would appear on the report.

▪ Header/Footer section: you can decide the look of the header and footer in your report