QuickBooks is the most widely used software for its amazing features that help in streamlining the business operations by making the accounting work quicker and hassle-free. But it is true that QuickBooks also gives some errors like every other software and a common error that is encountered by users is “QuickBooks unable to create an Accountant’s copy failed”.

It generally happens while preparing an accountant’s copy. This problem relates to the folder where the business file is stored. Most of the time, it is not clear why the error is actually occurring and what are the procedures to resolve this error. Well, if you are also facing the same issue and want to resolve the issue manually then you’ve landed on the right page. In this post, we will disclose the common causes, and troubleshooting solutions to resolve the error. So be sure to keep reading this post till the end. For more, connect with the team at accountingguide.co.

What is QuickBooks Accountant’s Copy?

The copy of the accountant is the version of a company file in QuickBooks which can be used when you proceed to work to make changes to the records. When you are all set to make changes in the QuickBooks Accountant Transfer file, you can reverts the changes already made for easy importing of the data to the company file.

Reasons that Evoke QuickBooks Unable to Create Accountant’s Copy Failed:

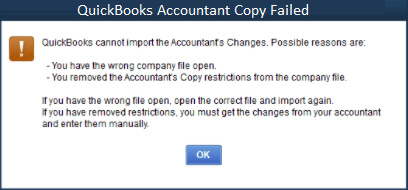

When the copy error of the Accountant occurs in QuickBooks, the following error messages may appear on the screen:We had an issue with sending your file to Intuit Server.

Warning

There was an issue submitting the changes to the accountant’s copy-file transfer server. Please try again later or you can save your file and email it.

These error messages can come into sight due to several possible reasons, and tracking the possible causes behind the error is an essential temperament for the error-resolution.

Check out the Main Reasons Stated in the Below-Given list:

- You use an outdated version of the QuickBooks program and it needs upgrading

- Size of the company file exceeds 200 MB or greater.

- Slow Internet or other networking issues.

- Windows Firewall prevents the upload operation.

- When there is harm in the company file of QuickBooks.

- Entering a long dash in MS Word and then copying it to the notes may also facilitate the mistake in making a copy of the accountant.

Easy Ways to Fix QuickBooks Unable to Create Accountant’s Copy Failed:

You need to perform different troubleshooting procedures for several error causes and you need to check which solution is the best and help you to eliminate the error. Here are a few solutions that you can follow:

Total Time: 35 minutes

Make Sure That There are No Special Characters Used in the Company Filename:

If you are saving your company files then make sure that you don’t use any special character and also no comma present in the filename and company name. After performing this solution, the error still continues than moves to the next solution.

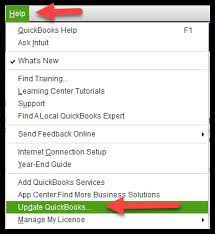

Update QuickBooks to the Latest Release Version:

Updating the Application Ensures you the Optimal Performance and also helps you to Resolve a Wide Range of Technical Glitches. To Get it Done, Follow the Below Steps:

💠 Go to the Help menu and then select Update QuickBooks Desktop

💠 Next, navigate the “Update Now” tab and make sure that reset update checkbox should be marked

💠 Now, choose “Set Updates”

💠 Once done then that will initiate the download process

💠 Restart the QuickBooks software once the downloading completes

💠 After that perform the on-screen instructions in order to install the new release.

Reduce the Size of the Company File:

In this Step, You Need to Confirm that you will Not Increase the Size of the QuickBooks File by 200 MB or More. If it does, Try to Reduce its Size by the Steps Given Below:

💠 Open the company file and then press F2 to open the “Product Details” window

💠 If the file size is greater than 200 MB, QuickBooks Desktop portable company file (* .qbm) may be attempted or restored

💠 Additionally, you should also attempt to transfer the QBX / QBY file manually, instead of using the Accountant File Transfer Program.

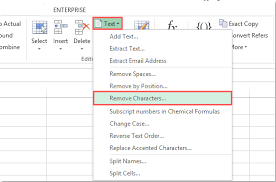

Check Out if There is a Long Dash in your Notes:

In this solution, you need to consider a few things if there is a long dash in the notes:

💠 Enter text directly in the clients’ notes without long dashes

💠 Next, create and paste the text with the help of the Windows Text Editor

💠 You should email your client the MS word document with an updated QBY format.

💠 Stop using a long dash in MS Word; however, a short dash is Ok.

💠 If you’re still bothered by the mistake, try the next solution.

Repair Damaged Data in the Company File:

If the Accountant’s copy file error is caused due to damage to the company file, then you can restore the company file backup and replace the damaged file with it to correct the error. You can then enter the transactions that have happened since the backup was run.

Related Topic: How to Backup QuickBooks Company Data file

Points need to consider when creating the Accountant’s Copy:

When the copy of the Accountant is saved, QuickBooks will show in the title bar on the computer screen that “Accountant’s Changes Pending” and remain the same until you add the changes from the copy of the Accountant or delete the limitations. In case you delete the limitations before the accountant sends the changes back, you will not be able to immediately make any adjustments in the application made by the accountant.

QuickBooks Desktop Limitations:

There are certain limitations needed to consider while doing adjustment with your Accountant’s copy file. Such as the users are not able to edit, add, delete, or void the payroll, sales orders, estimates, transfers of funds between inventory build assemblies, or accounts.

Begin with Creating the QuickBooks Accountant’s Copy:

The accountant may tell users to access the copy or backup file of an accountant, but in most cases, the preferred choice would be a copy of the accountant. The user can create a copy of an Accountant in QuickBooks by following the steps in this post we listed earlier.

Steps to Remove Accountant’s Copy Restrictions:

If you delete the restrictions of the Accountant’s copy, this means you are invalidating the original Accountant’s copy. It occurs when the copy becomes inaccurate for your Accountant. This happens when your accountant asks for a copy or company files of another accountant to be repaired due to damage to the records. Until lifting the constraints, make sure the company file has been backed up.

Below are steps mentioned to remove the restrictions from the Accountant’s copy?

💠 Initially, go to the “File menu” and then click on the option named “

💠 Next, choose the “Accountant’s copy”

💠 Now, select the “Client activities”

💠 After that, hit the “Remove Restrictions” option

💠 At last, click on the “Yes” button and then the “Ok” button.

Connect with the Team for more Queries

Hopefully, with the help of the above guidelines for how to fix QuickBooks Unable to Create Accountant’s Copy and you’ll be able to rectify your error successfully. However, if you find any kind of difficulty in rectifying the issue or have any other queries regarding the same then you can always connect with the QuickBooks Support team via dropping an email support@apropayroll.com. You can do a live chat for instant helps as the service is available 24*7 so feel free to connect them anytime. You can fill out the customer contact form along with the query details and the team of experts will get back to you in the minimum time frame with a complete solution.

Frequently Asked Questions

Q1. What error message do we receive when “QuickBooks Accountant Copy Failed”?

Ans: You may receive the following warning text if you transfer the Accountant’s copy using the Accountant Copy’s File Transfer Service (ACTF):

Your file could not be sent to the Intuit Server due to a technical issue.

Warning: The changes were sent to the accountant’s copy file transfer server, but there was a hitch. Please try again later, or save a copy of the file and email it to us.

Q2. What are the limitations of QuickBooks Accountant’s Copy?

Ans: You should be aware of the restrictions of the Accountant’s copy file’s capabilities. Payroll, sales, orders, or fund transfers across accounts are not editable, addable, voidable, or deleted.