Navigating the changing tides of information on coronavirus relief loans like the Paycheck Protection Program (PPP) isn’t easy. But what if you received PPP funds, what do you do? In order to avoid repaying the loan or any unused portions, it is essential to start keeping detailed records of your expenses immediately even if the guidance about loan forgiveness is currently unclear. Keeping a detailed track of expenses may help you in the future to avoid challenges. To explore more about PPP loans, you can easily connect with the accountingguide.co team on QuickBooks support by filling up the form or do 24/7 live chat.

What is QuickBooks PPP loan?

It is a part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act program that provides up to $349 billion in government-sponsored loans to help small businesses and other qualifying applicants afford to fund payroll costs and other operating expenses.

Once you receive the PPP funds then it is important to set up the loan account in your QuickBooks accounting software. Below are steps that help you to QuickBooks PPP Loan Account Setup. So, just go through the article till the end to explore more about the Paycheck Protection Program (PPP).

Steps for Setup QuickBooks PPP Loan Account

Open a Separate Bank Account for PPP: The Utmost Important:

💠 You need to open a separate bank account for your PPP funds after receiving the funds that can help you to handle things much better and easier. Your reports from your accounting software for the Paycheck program plan loans can be easier to produce.

💠 In order to open a new bank account, they may charge some costs so it is suggested you consult and take advice from your banker. Contact your bank to set up a separate business account that is recommended.

Also Read: QuickBooks PPP Loan Forgiveness on Payments to Owner

Setup the PPP Loan Account on the Chart of Accounts (COA):

Chart of Accounts (COA) is an organizational tool that provides a digestible breakdown of all the financial transactions that a company conducted during a specific accounting period.

💠 The loan is a liability until it is determined how much of the loan will be forgiven

💠 It is suggested that the account be a “Long Term Liability”

3 Steps to Setup the Loan Entries in QuickBooks:

Set up of the loan entry in accounting software is pretty much similar to other accounting software. But you only need to alter a few steps according to accounting software. It mainly involves three steps that are discussed below:

💠 Creating a new PPP bank account

💠 Create a loan account

💠 Record deposits of PPP funds

Let’s know these Steps in Detail.

Creating a New PPP Bank Account:

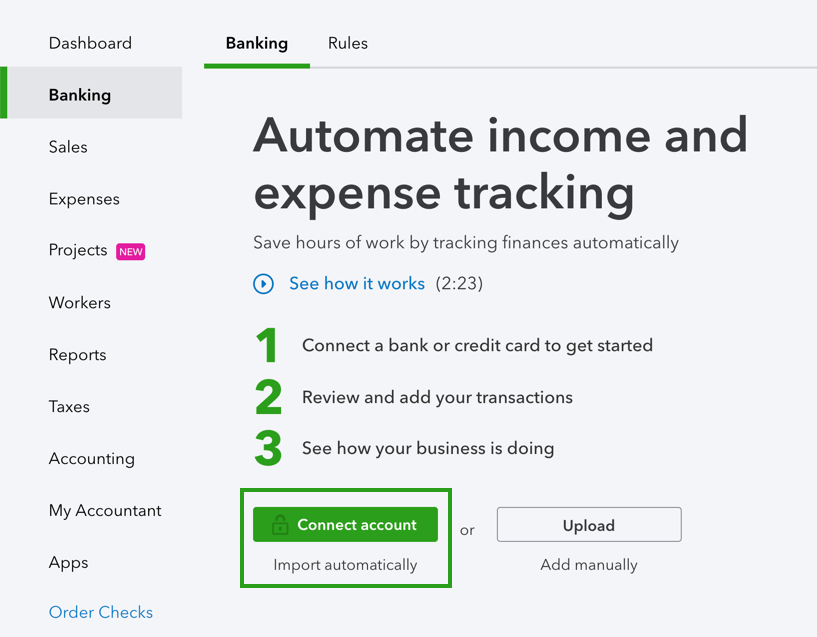

If you’ve created the bank account before then the steps are almost identical. Only follow the same steps to build a credit account with PPP. The next step is to use your online credentials to connect your bank account to the accounting software.

Create a Loan Account:

Although you can forgive your PPP loan you need to set it up like any other loan. To configure simply go to the accounting software section that deals with the account table. You should set it up as a liability account whilst creating the account. Don’t forget to make a special name for that account.

Record Deposits of PPP Funds:

Bank account and credit account were created. The next and final step is to record the cash receipt. You may need to transfer the funds to a PPP account from the existing bank account depending on how you received the amount. In that case, ensure the total PPP loan is transferred.

Make sure to deposit the amount,

Few Points that Need to Keep in Minds:

💠 The date the deposit was financed using the loan.

💠 The Total deposit should correspond to total PPP funds.

💠 The account will be the point of payable PPP loan account.

💠 The memo should be referred to as “PPP funds earned at [DATE].

Creating Reports is also helpful:

💠 This method maintains a clean trail of PPP Income & Expenditures, but will not show expenditure by expense type for the new PPP Bank.

💠 You need to create a custom report to obtain an expenditure report, but you may end up transposing that data to Excel for reporting purposes on loans.

What are the Eligible Payroll Protection Program Costs?

The eligible Payroll costs must be commenced before 15th February 2020. It includes:

💠 Interest on mortgage commitments

💠 Rent and under lease agreements

💠 Utilities such as electric, telephone, water, gas, and internet

💠 Many other benefits like salary, medical or sick leave, retirement, etc.

How to contact us?

Even if you haven’t received a loan, tracking the corona virus cost to your business is important. To track corona virus costs, set up a line item in your accounting system. That would include time spent (such as remote work planning), IT costs, cleaning/maintenance supplies, etc.

For more information or have any queries regarding QuickBooks PPP Loan Account Setup. You can easily connect with QuickBooks Payroll Protection program helpdesk email at support@apropayroll.com. If you are unable to reach out via number, you can submit a Query form along with your details and team will get back to you within 2-3 hrs or do a QuickBooks live chat with dedicated professionals.