The term “chart of accounts” refers to the detailed list of minor categories that fall under the broad categories of “asset,” “liability,” “net assets,” and “revenues & expenses.” In other terms, you could say that the chart of accounts serves as a filter for data coming into the accounting system from the outside world. The chart of accounts is wholly dependent on the report’s premise. QuickBooks Online for nonprofits is an additional option. Chart of Accounts can be set up according to your QuickBooks account. Additionally, by purchasing extra subscriptions, you can set up several accounts in QuickBooks Online. Get a better grip on the setup chart of accounts nonprofits QuickBooks by going through this article with your full concentration.

What are the Different Types of Accounts?

Users usually believe that the bank only offers the two types of accounts—current and savings—but in reality, there are six sorts of accounts that the financial institution offers.

The six categories of accounts are:

Checking Accounts: Checking accounts are used to regularly take money from and deposit it into accounts at financial institutions. A debit card is not what it is.

Money Market Accounts: Money market accounts, also known as money market deposit accounts, are those that pay interest on deposits of money based on the money market’s current interest rates. Because it is a unique form of bank, it offers several extra features that standard accounts did not.

Checking Accounts: The procedure of withdrawal and deposit of money in an account on a daily bases at financial institution is known as checking account. It is not a debit card.

Banking Account at a Glance: The account at a glance is prepared to provide the summarized view of the account.

Individual Retirement Arrangement: It is the special type of saving account in which you can save your money for the purpose of creating a retirement corpus.

Certificates of Deposit: It is usually issued by the commercial bank. Certificates of deposit accounts means that the bank provides you some rate of interest on the amount deposit in bank for some time period.

Steps to Categories the Accounts in QuickBooks

In the QuickBooks, you can classify accounts according to transactions.

These are the procedures to categorise the accounts:

➢ The transaction menu must first be opened

➢ Search the list for the transaction option

➢ Choose the business if the transaction is business-related

➢ Choose the personal option if the transaction relates to your personal option

➢ You can review each category by clicking on it in the category column

➢ If you want to alter the account’s category, click on the link for that category

➢ After you’ve finished changing, click the Save button to save all of the changes you’ve made in the category area.

Visit Details: How to Create Modify QuickBooks Memorized Transaction

Advantages of Setting Up Chart of Accounts

➢ The chart of accounts displays the format of the balance sheet and the profit & loss reports.

➢ Using a chart of accounts to record transaction details is simple.

➢ Your unique organisation is reflected in your chart of accounts.

➢ The definition of an organization’s transaction in depth is aided by the chart of accounts.

➢ With the use of a chart of accounts, it is simple to identify your company’s budget because it depends on the accounts.

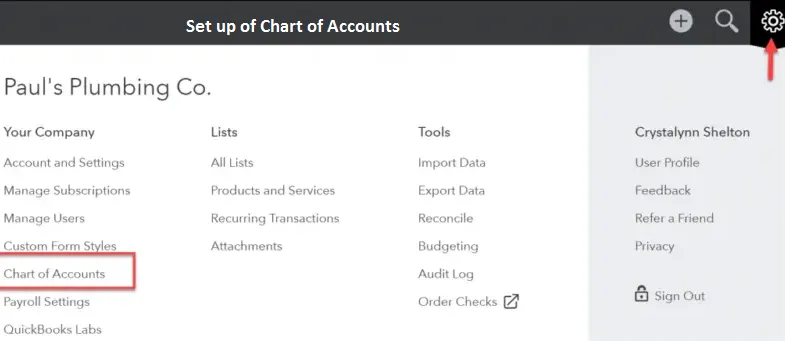

Set up of Chart of Accounts

There are three columns on the COA. Therefore, you must first construct a blank chart and add columns to it before generating the Chart of Accounts. The creation of a chart of accounts is basic and easy.

Let’s make it by taking the actions listed below:

➢ Assign Accounts Numbers to the Business Account: The numbers that are assigned to each and every account number are known as assign account numbers.

The common account numbers assigned to the names of common accounts are as follows:

➢ Liabilities: 2000 to 2999

➢ Operating expenses: 6000 to 7999

➢ Assets: 1000 to 1999

➢ Income: 4000 to 4999.

➢ Create the name of the business accounts: You must name the accounts for the business expenses you are reporting, such as bank fees, cash, taxes, etc. It makes it easier for you to locate your account later on when you need it.

➢ Organize the names of the account into one account category type: According to the name and purpose of your account, you must choose one of the four account types, namely assets, liability, expenses, and income.

QuickBooks for Nonprofits

It is a special method that nonprofits organisations use to plan, record, and report their finances. The main goal of profit is to make money, but the nonprofits mostly concentrates on the accounting’s accountability components.

➢ Once you have a basic understanding of planning and implementation, you may begin setting up QuickBooks for your nonprofits.

➢ You require classes utilities and the use of customers and resources to set up QuickBooks so that you can run reports by locating a source or application.

➢ You must complete setting up QuickBooks in order to code and report for nonprofits.

➢ Find the QuickBooks version that is supported by Techs up by searching.

Basic and Practice of Nonprofits According

There are five fundamental and common practises in nonprofits accounting, including:

- Non profit accounting statements and reports: Not everyone can access free nonprofits accounting. Anyone with access to the nonprofits account must be familiar with GAAP requirements. The term “Generally Accepted Accounting Principles” is called GAAP.

- Outsource non profit accounting: There will be one specialised team in your business that is capable and skilled at handling accounting requirements. If so, it’s helpful to know that you can outsource your account in order to adequately handle the needs of accounting if you don’t have a crew dedicated to it.

- How the nonprofits account is different: The nonprofits account, often known as fund accounting, is a sort of accounting. As was previously mentioned, the focus of nonprofits accounting is on the accounts’ accountability.

- Best practices of nonprofits accounting: All bookkeeping transactions, including account and balance sheet reconciliations and the preparation of financial decisions for managing your organisation, are under the purview of your nonprofits account.

- Non profit accounting firm recommendation: When you outsource your finances to a reputable team, you will have access to people that are not just knowledgeable about finances but also familiar with the pitfalls of the nonprofits sector.

Step by Step Instructions to Configure the Account for Nonprofits Organization

There are two ways to set up an account for a nonprofits organisation, and they are as follows:

Change the Company’s Status to Nonprofits

➢ Initially, go to the “Settings” from the menu

➢ Choose the account and settings option from the settings page

➢ After that, choose the Advance option on the account and setup page

➢ In the company type, click on the Edit button

➢ Select the nonprofits organisation option after choosing the tax form from the drop-down

➢ Finally, press the Save and “Ok” button.

Change the Customers to Donors

➢ In the beginning, select the Settings from the menu

➢ Select the account and settings option from the options pane

➢ Then choose the advance option on the account and setup page

➢ Go to the order preference menu and click the Edit button

➢ Choose the customer label from the drop-down menu, then choose Donors

➢ At last, press the Save and “Ok” button.

For Free Consultation With QuickBooks Experts: Just Call or Chat With Us

Steps to Setup Chart of Accounts Nonprofits in QuickBooks

The simple procedures for setting up the Chart of Accounts in QuickBooks are as follows:

➢ You must first choose the command for the list of accounts

➢ Next, click the Accounts button from the menu now

➢ In order to add a new account, click the account tab from the menu

➢ Now, choose the New option from the drop-down menu of accounts

➢ Choose the account type button, then choose the appropriate option from the selection list

➢ Click Continue to move to a new page as your next step

➢ Once done with that, check for the sub account

➢ Click the main account after selecting the sub account.

Conclusion

Setting up your nonprofits’ QuickBooks can take some time and work, but it’s a crucial step in ensuring that your business follows fund accounting procedures precisely. This will enable the nonprofits to properly account for how donated funds are used and report that information to the IRS as well as to the organization’s funders and constituents, who may be more likely to continue contributing to the nonprofits in the future if they can see how their money is being used and have faith in the organization’s capacity to manage and track their funds.

A Frequently Asked Questions

How Do I Determine the Type of Accounts to Set Up?

There are eight steps to choosing a new bank and opening a new account that you must remember:

➢ Choose the appropriate account type

➢ Find banks that have no or low fees by doing a search

➢ Think about the ease of a bank branch

➢ Check out credit unions

➢ Look for a bank that can accommodate your lifestyle

➢ Analyze each digital aspect of the bank

➢ Recognize the bank and possess complete, accurate understanding about it

➢ Read and record all the reviews of the banks you are thinking about.

How Do I Enter Nonprofits Income into QuickBooks?

These are the procedures to enter income for a nonprofits:

➢ You must first access your QuickBooks account and choose the customer from the drop-down menu

➢ The create credit memos/refunds option must be chosen from the customer drop-down menu

➢ Select the customer whose account has to be edited once you’re done with the above step

➢ The item that was used in the purchase that you are refunding must now be entered

➢ Click “Ok” after pressing the save button to preserve the modifications.

What are the Steps Involved in Assigning Numbers to the Chart of Accounts in QuickBooks?

The basic and quick processes for assigning numbers on the Chart of Accounts in QuickBooks are as follows:

➢ Select Settings in the navigation bar

➢ Choose the Accounts and Settings option from the Setting box as your next step

➢ To edit an account, select the Edit tab in the options for the chart of accounts

➢ Go to the settings tab followed by selecting the “Enable Account Numbers” option

➢ Click the show account numbers button from the options if you wish to display account numbers on the report

➢ Finally, press the Save and Ok button to save the information and proceed to the account.