Are you relatively new to QuickBooks? Then this blog will be of great help to you. Here, we will tell you how to Add closing and opening information into my QuickBooks account. Simply go through the blog till the end and implement the steps mentioned therein.

First things first! Let’s get to the basics, to start with.

🔰 What is the Add Closing and Opening Information into my QuickBooks Account?

When a new account is created in QuickBooks, a day is picked from which you can track all your transactions. For that day, the balance of your bank account needs to be entered. This is way how QuickBooks matches your records from the beginning. This starting point is known as the opening balance or opening information of your QuickBooks account. On the basis of this information , QuickBooks summarizes all the previous transactions before the starting point.

🔰 Procedure to Add Opening Information Into a QuickBooks Account

Here’s how you can enter an opening balance /information for accounts you create in QuickBooks-

Total Time: 40 minutes

Step 1: Enter Opening Balance

👉 Open QuickBooks Desktop

👉 Navigate to the Company menu

👉 click Chart of Accounts.

👉 Right-click on it and select New.

👉 choose Bank or Credit Card as the account type.

👉 select Continue.

👉 Assign a unique name to your account so that it becomes easy to identify later on.

👉 Fill in the required details in the data fields.

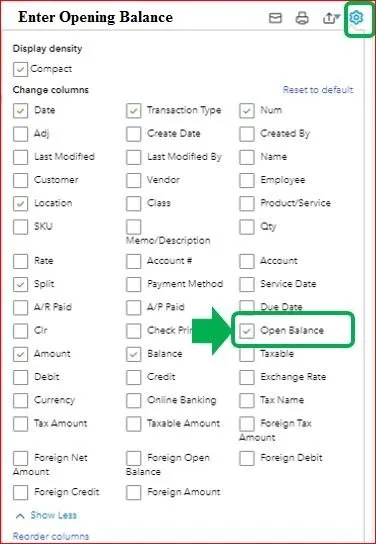

👉 Click on the Enter Opening Balance tab. It will be available if you are entering the transaction for the first time. After you enter a transaction, this button will appear as Change Opening Balance.

👉 Fill in the ending balance and ending date from your last bank/credit card statement

👉 Click Ok to proceed

👉 Click Save & Close

Step 2: Check the Opening Balance Entry

After you the opening balance is entered, go to the account register and make sure that it is correct. The Opening Balance Equity account should not be having any remaining balance.

👉 Go to the Lists menu

👉 Click Chart of Accounts.

👉 Search for the Opening Balance Equity account and click to open it.

👉 Check if the account balance is 0.00.

Step 3: If the Balance is Not Zero, Note Down the Remaining Balance.

Then you need to run a Balance Sheet Report for the last year. Please follow the steps below-

👉 Go to Reports

👉 hover the cursor over Company & Financial.

👉 Click on the Balance Sheet Standard tab

👉 From the Dates dropdown list, click Last Fiscal Year.

👉 Go to the Equity section

👉 check the Retained Earnings balance.

👉 Compare the last year’s Retained Earnings balance with the remaining balance mentioned in the Opening Balance Equity account.

If they match, you should know that everything is balanced. If not, get in touch with your accountant.

Need Expert Help:

Complete Guide to QuickBooks Closing Entry

🔰 Procedure to Add Closing Information into a QuickBooks Account

Here’s how you can enter a closing balance /information at year-end, for accounts you create in QuickBooks-

⏩ Search revenue accounts in the Trial balance that includes the capital and revenue accounts in the company ledger. A credit balance would be reflected here. You will need a ‘debit entry’ to balance it in every revenue account. It will transfer the credit balance into the income summary account

⏩ Secondly, search for the Expense Accounts in the trial balance and you will notice a debit balance here as well. You will need to make a corresponding Credit Entry in the income summary account against every Expense Account. The total of the Expense Account should be zero now

⏩ After finishing all the entries, Add closing and opening information into my QuickBooks account if you notice a credit balance in the income summary account or, if the debit amount is less than the Credit Entry amount, you would understand that there is Net Income. On the other hand, if you find that debit balance is more than the credits, there is a Net Loss.

⏩ Lastly, you need to close the Dividend Account to the retained earnings. The Dividend Account will have a debit balance. Hence, you will need to credit the Dividend Account and debit the Retained Earnings Account. The retained earnings will display the net income amount given to it.

In the discussion above, we have shown you a step-by-step procedure to Add closing and opening information into my QuickBooks account. If you are still experiencing any difficulties in carrying out the above-mentioned steps or if you have any more queries, we would recommend you to speak to some of the authorized QuickBooks Chat experts.

Frequently Asked Questions

Q 1. How to Record Opening Balance of Foreign Currency

Ans: Please follow the sequential steps mentioned below-

🔹 Navigate to the panel on the top right

🔹 Click on the Settings tab

🔹 Now navigate to the Bank Deposits tab

🔹 Select the name of the bank where you want to record the entry

🔹 Choose your preferred currency

🔹 Now click on the Add Deposits tab

🔹 Select an account

🔹 Then enter the opening figure

🔹 Click Save to proceed

🔹 Your opening balance will start reflecting on your foreign currency account.

Q 2. How Can I Turn off Automatic Matching & Recording of Payments in QuickBooks?

Ans: You need to first turn off the automatic reconciliation if you need to match and record fees and deposits manually. Here are the steps to follow-

🔹 Go to Banking

🔹 Click on Record Merchant Service Deposits.

🔹 Navigate to Deposit Settings

🔹 then click on the toggle named ‘Auto match is record is turned on’.

🔹 Click on Save Settings to finish